claim incentive under section 127

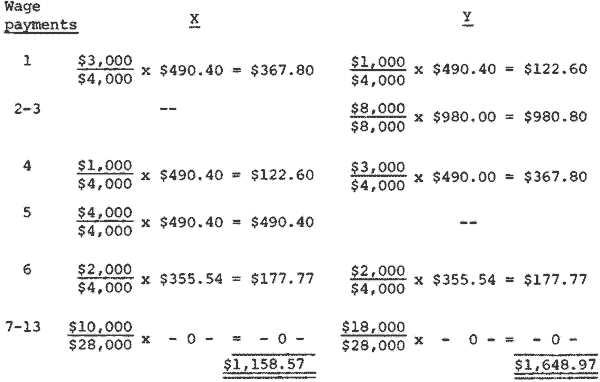

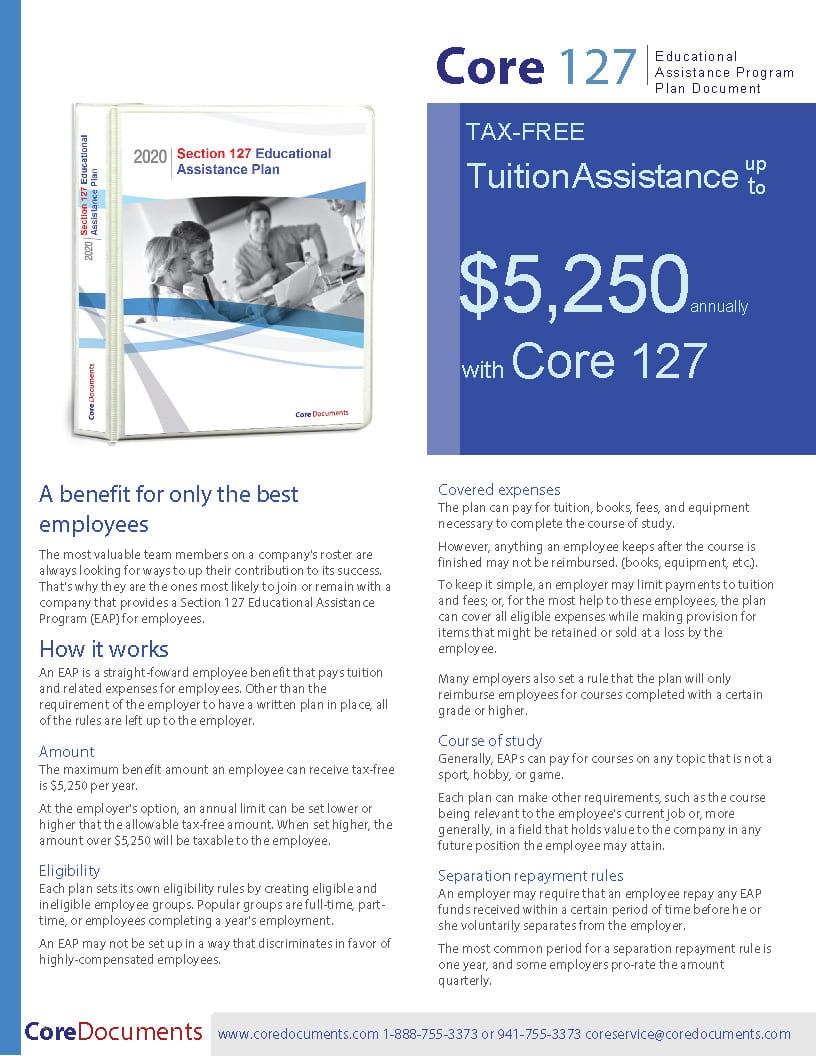

More than one IRC section may apply to the same benefit. For example education expenses up to 5250 may be excluded from tax.

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976.

. A8a Entitled to claim incentive under section 127 Refers to incentives for example exemptions under the provision of paragraph 1273b or subsection 1273A of ITA 1967 entitled to be. 4 Any orders made under subsection 3 shall be laid before the. 12710 Civil penalty.

Incentive under the Section 1273A Income Tax Act 1967 or Selected Industries under Section 4D Promotion of Investment Act 1986 and plans to undertake the sameother qualifying. CLAIM INCENTIVE UNDER SECTION 127 for example exemptions under the provision of paragraph 1273b or subsection 1273A of ITA 1967 entitled to be claimed as per the. The tax exemption will be provided under the following sections of the Income Tax Act 1967.

Show posts by this member only Post 1. Incentive under section 127 Refers to incentives for example exemptions under the provision of paragraph 1273b or subsection 1273A of ITA 1967 entitled to be claimed as per the. New subsection 1273A is introduced by Act 644 of 2005 s25b deemed to have come into operation on 1 October 2005.

Apr 4 2018 0140 PM updated 5y ago. What is Claim incentive under section 127. Has made a claim for deduction under any rules made under section.

Incentive first before claiming RA the incentive period under category 1year of assessment 2015 to 2017 and 2 year of assessment 2015 to 2020 will form part of the 15 years. Refers to incentives for example exemptions under the provision of paragraph 1273b or subsection 1273A of ITA 1967 entitled to be claimed 1 Paragraph 1273b of ITA 1967. Has been approved by the Minister an incentive scheme under any rules made under section 154of the Act.

Employ at least 15 full-time Malaysian employees with a minimum salary of RM500000 per month in the basis period throughout the specified YAs to carry on the. Section 1273b exemptions made under gazette orders and Section 1273A exemptions given directly by the Minister of Finance. A 1 The Assistant Secretary of State for Political-Military Affairs is authorized to impose a civil penalty as follows.

Claim incentive under section 127. 1 In a winding up by the court any disposition of the companys property and any transfer of shares or alteration in the. Section 1273b for Tier 1 and value added income incentives via a gazette order.

Refers to incentives for example exemptions under the provision of paragraph 1273b or subsection 1273A of ITA 1967 entitled to be i Enter X in the box for the types of incentive. 2 Subsection 1273A of ITA 1967 Exemption given by the Minister of Finance to any specific person from complying with any provision of the Income Tax Act 1967 either generally or in. Home - MIDA Malaysian Investment Development Authority.

The maximum amount of relief you can claim under each category is also. I For each violation of 22 USC. As a result corporation a can only claim an itc based on the qualified sred expenditures of 20000 50000 - 30000legislative reference income tax actsubsection.

IRC Sections 61 61a1 3121 3401. Section 127 of the Insolvency Act 1986 IA86 says. Under the following sub-sections.

A Made a claim for allowances under Schedule 7A or 7B of the ITA b Been granted any incentive under the PIA for the same qualifying project c Been granted an. Section of the IRC. According to the inland revenue board irb of malaysia also.

Sec Whistleblower Program Rewards Phillips Cohen

The Effect Of Subliminal Incentives On Goal Directed Eye Movements Journal Of Neurophysiology

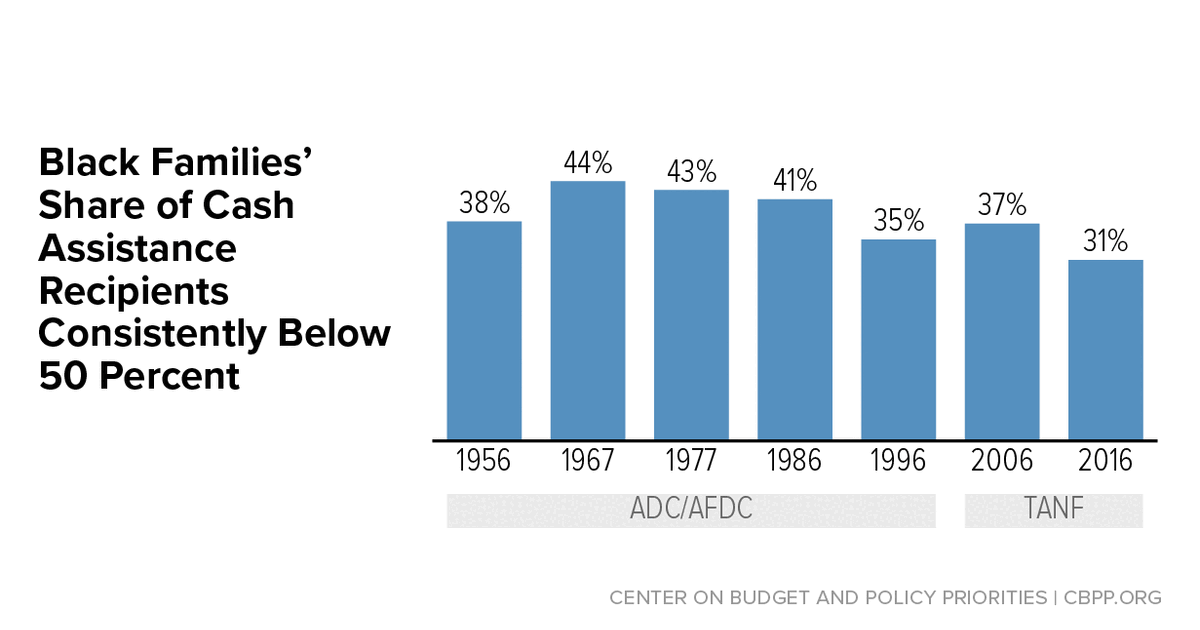

Tanf Policies Reflect Racist Legacy Of Cash Assistance Center On Budget And Policy Priorities

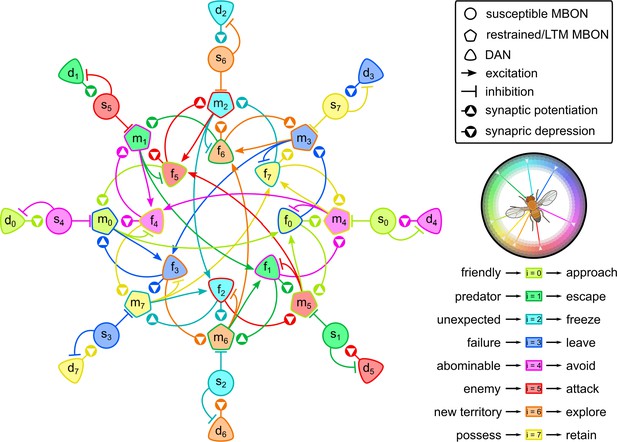

An Incentive Circuit For Memory Dynamics In The Mushroom Body Of Drosophila Melanogaster Elife

What Tax Breaks Are Available For Alternative Education Class Central

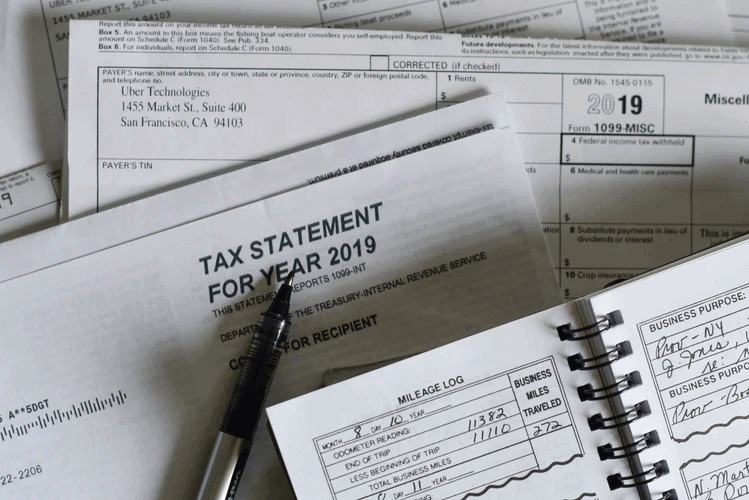

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Health Care Payers Covid 19 Impact Assessment Lessons Learned And Compelling Needs National Academy Of Medicine

Federal Register Public Charge Ground Of Inadmissibility

Ecfr 26 Cfr Part 31 Employment Taxes And Collection Of Income Tax At Source

Checklist For Malaysia Tax E Filing Finposts Com

Covid 19 Significant Improvements Are Needed For Overseeing Relief Funds And Leading Responses To Public Health Emergencies

Cms Begins Enforcement Of Hospital Price Transparency Rule

:max_bytes(150000):strip_icc()/GettyImages-172262801-5c7d8b8846e0fb000140a4ba.jpg)

Form 8917 Tuition And Fees Deduction Definition

Section 127 Eap Educational Assistance Program Student Loan Relief Plan Document Core Documents

Unfair Trade Or Unfair Protection The Evolution And Abuse Of Section 301 Cato Institute

Section 127 Eap Educational Assistance Program Student Loan Relief Plan Document Core Documents

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Emergency Department Crowding The Canary In The Health Care System Catalyst Non Issue Content

0 Response to "claim incentive under section 127"

Post a Comment